Contents

In a currency pair, the currency on the left is known as the base currency and the currency on the right is known as the quote currency. The exchange rate is the term used to explain how much of the quote currency is needed to buy 1 unit of the base currency. Forex trading works by buying one currency and immediately selling another. This is like when you sell Canadian dollars to buy US dollars before travelling to the US. The currencies that are being bought and sold at the same time are known as a currency pair.

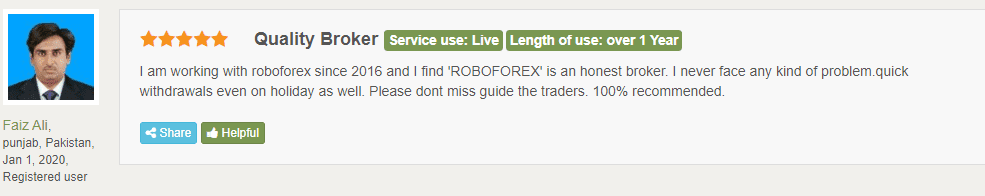

Forex trading platforms are owned by forex brokers who allow traders to open accounts with them so they can trade in any currency of their choice. Due to the increasing interest in forex trading, the number of brokers in Canada has also increased in recent years. Not all providers are similar when it comes to trading offers, conditions, and other services. In addition, every trader has his own needs and techniques.

RBC’s foreign currency conversion spread starts from 200 basis points (1.60%) and can go down to 0.10% for transactions over $2 million. A spread of 1.60% makes RBC’s currency conversion fee similar to Wealthsimple, but higher than Interactive Brokers’ spread of just 0.2 basis points. With the fast emerging Nigerian economy, Nigerian forex market players have witnessed swift growth during the past years, and a lot of average Nigerians are contributing to the fx market. Trade with smaller amounts for a start, then increase your investment as you gain more experience.

- Build your confidence and knowledge with a wealth of educational tools and online resources.

- The table above the trading platforms offered by the different forex brokers.

- National Bank Direct Brokerage lets you trade Canadian and U.S. stocks and ETFs with no commission.

- But as a modern company which keeps up with the times their portfolio nowadays also includes Bitcoin trading in the Form of CFDs.

However, both the trader and the broker must keep an accurate record and statement of every transaction for future verification. If you open a trading account with a forex broker, you usually have to make an initial deposit of a specified minimum amount. This depends on the provider, but often also on the account type.

You can start forex trading in Canada simply by finding a forex broker that is right for you and opening an account. You then need to download the broker’s specific trading platform or access it via a desktop computer. Once you have deposited into your forex account you are ready to make your first trade. Forex is the term used for the foreign exchange market, also known as the FX market, which determines the exchange rate of all global currencies.

Over the past ten years, CMS Forex has quickly become one of the worlds leading online retail currency trading institutions, providing secure, user-friendly Forex trading software. CMS Forex is positioned as an industry leader in the Forex marketplace and continues its growth while striving https://forexbroker-listing.com/ to provide its clients with a better trading environment. Based out of New York, CMS Forex and its affiliates now have offices in London, Boston, Tokyo, Bermuda, Saint Petersburg, and Shanghai. CMS Forex strives to serve both the retail and institutional segment of the Forex community.

The tools help them know where to take trading positions and when to exit the market, so they don’t run at a loss. These are accounts loaded with virtual money and don’t expose a trader to any risk. Demo accounts allow traders to check the trading platform, research area, and trading conditions before committing real money. Most demo accounts are time-limited but are easy to reactivate.

InvestingForMe Canada

Forex trading is legal in Canada and is controlled by both local regulators and the IIROC . When you are considering which forex broker in Canada is best for you, you want to confirm that they are registered with the IIROC by checking their broker licence. Before forex broker listing placing your first forex trade you want to consider developing a trading plan. Several trading plans could work for you, but three good forex trading strategies good for beginners are news trading strategy, trend trading strategy and momentum trading strategy.

Automatic option assignments and exercises are charged $15, while manual option exercises come with a commission of $43. Wealthsimple Trade was revolutionary in bringing commission-free stock trades to Canada, a concept similar to Robinhood in the United States. There’s no minimum balance requirement, which means that you can start trading with as little as $1. You can only trade Canadian and U.S. stocks with Wealthsimple. While stock trades are commission-free, Wealthsimple charges a 1.5% fee for converting CAD to USD, and vice-versa.

I’d like to view FOREX.com’s products and services that are most suitable to meet my trading needs. I understand that residents of my country are not be eligible to apply for an account with this FOREX.com offering, but I would like to continue. Stay informed with real-time market insights, actionable trade ideas and professional guidance.

What is Forex Trading Canada

Do well to make your decisions and wish you good luck in your trading endeavors. You can easily copy trades from over five thousand traders with the integrated copy trading function. An unlicensed broker is a red flag because they may close up shop at any moment and run away with your money.

National Bank’s InvestCube is similar to a robo-advisor that automatically rebalances your portfolio into various ETFs. InvestCube requires a $10,000 minimum balance, and charges an annual rebalancing fee of 0.3% to 0.5%. Scotia iTRADE offers a list of over 100 ETFs that can be bought and sold commission-free if you hold them for at least one business day. This includes index ETFs such as the iShares Core S&P 500 Index ETF and the iShares Core MSCI EAFE ETF. It also includes sector ETFs, dividend ETFs, fixed income ETFs, and commodity ETFs. This allows you to buy and sell a wide variety of ETFs without having to worry about paying commissions on the trades.

Traders Union Announces the Best Forex Brokers in Canada 2021

Plus, the CIBC Smart Account is a bank account that offers free unlimited Interac e-Transfers and debit transactions, with free SPC+ membership. Options trading for young investors still come with a commission of $6.95 plus $1.25 per contract. Forex is an abbreviation of foreign exchange and involves trading different international currencies by exchanging one for the other. Forex traders take advantage of price movements of these currencies to earn profit online using trading platforms.

One unique feature is that Oanda allows PayPal deposits via e-cheque. Other deposit methods include debit cards and bank wire transfer. Withdrawals can also be made back to your PayPal account, debit card, or bank account via wire transfer. You can earn interest on your cash balance, however, this is paid at Prime – 5.50% for CAD accounts. This means that the prime rate will need to be at least 5.50% before you’ll earn any interest on your cash balance with Questrade.

You may choose a broker based in Canada or a foreign broker; however, their location doesn’t matter. Opening a demo account costs nothing; many brokers will automatically grant you one when you open a trading account with them. Another reason for the stability of the Canadian dollar is the strong regulation by the government and its central banks. When opening an account with a Forex broker, take time to read through the Customer Agreement and Terms and Conditions to understand the steps the broker will take to protect your funds.

FXCM is one of the most popular forex brokerages available for Nigerians. FXCM fx investment company is a prominent ticket of online forex trading services and other complementary services. IC Markets is also one of the best forex brokers in Nigeria. IC Markets bridges the difference between retail and institutional traders, making trading relatively easy for every one of their clients. The levels of access that make up the foreign exchange market place are determined by the size of the “line” .

RBC does not offer other foreign stocks listed in other countries outside of Canada and the U.S. RBC Direct Investing covers up to $200 in transfer fees if you transfer $15,000 or more to RBC. OctaFX is a foremost forex investment company your funds are safe with. Since its creation, it has experienced noticeable expansion and several testimonials.

Based on your selection, you will register for an account with EF Worldwide Ltd, which is authorised and regulated by the Financial Services Authority of Seychelles . First you need to calculate how many pips the price has moved. Because your profit and loss will be the pip movement multiplied by the size of your position. Exotic Pairs – the exotics are made up of major currencies paired with the currencies of emerging economies. The exotic currencies are being traded more and more often by speculators. We test the sign-up process over and over again to make sure everything goes smooth.

CIBC Investor’s Edge Margin Rates

Trade 55 currency pairs on fixed spreads, plus CFDs on crypto-currencies, stocks, indices, bonds and commodities. This account, registered in the British Virgin Islands, has significantly higher leverage. Canada has shown leniency towards receiving and sending money to and from international brokers and forex traders. The fx trading companies in the country adhere to all the anti-money laundering laws existing in the country. It is illegal to send money via any means to a forex trading company outside the shores of the United States and some other countries.

From charting to futures pricing or bespoke trading robots, brokers present a variety of tools to boost the trading expertise. FP Markets is a true ECN broker with razor-thin spreads and deep liquidity. Trade CFDs on over 1,000 stocks, indices, commodities and currency pairs through MetaTrader 4 or 5. The laws existing in Canada state that brokers can operate in the country without obtaining any regulatory license. Be that as it may, a broker will enjoy several benefits if it gets regulated and holds a regulatory license in Canada.